Chapter 3: The Views of Investors ~ Irish Investment In China. Setting New Patterns

Introduction

Introduction

As indicated above, traditional Irish outward FDI to the US and Europe is disproportionately horizontal in nature and is concentrated in the non-traded sector. (Barry et al, 2003) This chapter explores the views of business executives as to the rationale underlying their investment in China, their experience since investing, the disincentives and barriers to investing in China, and the role which executives see for state support in ameliorating the locational disadvantages which China poses.

By analysing the organisation and scope of activities of Irish MNEs which have invested in China, conclusions can be drawn as to whether Barry et al’s model is applicable to Irish FDI into China. The experiences of executives in both the Irish and non-Irish MNEs categories allow us to draw conclusions as to the locational challenges which China may pose. These perceptions and an analysis of the investment climate in the next chapter will permit conclusions to be drawn as to whether the validity of our sub-hypothesis holds, namely that the Chinese investment climate is considerably different from that faced by Irish investors in developed economies, the traditional location for outward FDI.

Should significant locational disadvantages be found to exist, within the meaning of Dunning’s eclectic paradigm, our prescriptive research question will examine the potential role which exists for government to assist potential investors.

This chapter sets out the results of the research undertaken for this study. Initially, the profiles of the investing companies (both Irish and non-Irish) will be set out, but in a manner which respects the confidentiality offered to interviewees. This will be followed by a consideration of the investment rationale and the available incentives, which drove the MNE to invest in China. Using this framework, the locational advantage which China offers can be identified.

Locational disadvantages will also be explored by examining the experience of executives since investing. The manner in which MNEs protect their ownership advantage through utilising internalisation advantage will offer guidance to potential Irish investors. Perceptions on the role of the state will be explored, which will assist in the consideration of our prescriptive research question. This will be followed by an evaluation of the views of Irish MNEs which have invested in Eastern Europe. It will be interesting to note if their perceptions as to the challenges facing investors in China will be borne out by the view of both Irish and non-Irish MNEs which have already invested in China.

Profile of the MNEs included in this Research – Irish MNEs

There is a significant variation in the size and scope of the Irish MNEs which have invested in China. The average size of the MNE’s investment in China was € 168 million. However, this figure is skewed by one large investment greater than €1 billion. When this investment is excluded, the average investment of Irish MNEs was € 6.3 million, which represents a significant commitment on the part of the parent Irish firm. The average number of employees in the Chinese subsidiary of Irish MNEs was 332. Again, this is distorted by the size of one MNE. Excluding this MNE, the average was 49 employees. This is not a large number of employees by Chinese standards. Perhaps this small number can be accounted for by the fact that just under half of the subsidiaries are in the hi-tech sector, where employee productivity tends to be high, and another is in the property sector, but not directly engaged in construction projects. LOCOmonitor (2006) found that the average number of employees in the overseas subsidiaries of Irish MNEs is 147. Taking all Irish investments in China, the number of employees is higher than the global average.

Turning to the parent Irish MNE, globally Irish MNEs which have invested in China had an average annual turnover of € 1.4 billion. Again there are large divergences within this average figure. The average number of employees globally was 4,247. This data gives an indication of the size and diversity of the MNEs which were included in this research.

Having analysed the activities of the Chinese subsidiaries we can say that, of the Irish MNEs which have invested in China, just over 80% are in the traded sector. The proportion between vertical and horizontal FDI is broadly equal. These results have significant implications for this research and indicate that Barry et al’s model is not directly applicable for the current wave of Irish investment in China, as it is largely in the traded sector and could not be described as disproportionately horizontal. We shall return to these findings in chapter five, when the nature of Irish FDI into China is explored. Read more

Chapter 4: A Land Of Opportunity And Challenge ~ Irish Investment In China. Setting New Patterns

Introduction

Introduction

Li and Li (1999: 11) contend that ‘for potential foreign investors, a omprehensive understanding of the investment environment in China – including its unique history, culture, political system, socio-economic regime, legal system, infrastructure, and consumer behaviour is essential for the establishment of successful ventures in China’.

This paper will draw together the data generated by this research and identify the locational advantages and disadvantages which China holds for Irish investors. Initially the locational advantage which China offers will be considered as a means of appreciating the opportunity which China offers Irish investors.

This will be followed by a consideration of the locational disadvantages which China poses in the areas identified in the literature and through this research, namely the regulatory, cultural and legal frameworks. The literature review identified the legal framework as challenging, so issues raised in this research, namely contract law and intellectual property rights, will be considered.

Finally the effects of regionalism will be discussed with both locational advantages and disadvantages identified. At the conclusion of this paper we will be in a position to answer the question posed in the sub-hypothesis as to whether or not the business environment in China is different from that experienced by Irish investors in other markets. If this is the case, this analysis will also assist in providing an answer to our prescriptive research question as to the desirability of state involvement in the facilitation of Irish FDI into China.

Locational Advantages which China offers

The literature review points to the considerable advances which China has made in attracting inward FDI since the opening-up policy was introduced in 1979. MNEs continue to recognise the locational advantage which China offers and are seeking to exploit their ownership and internalisation advantages by investing in China.

China’s overall record since reforms began in 1979 is dazzling, and its performance is in many ways improving. Annual real GDP has grown about 9% a year, on average, since 1978 – an aggregate increase of some 700%. Foreign trade growth has averaged nearly 15% over the same period, or more than 2,700% in aggregate. Foreign direct investment has flooded into the country, especially throughout the past decade… The country has developed a powerful combination – a disciplined low-cost labor force; a large cadre of technical personnel; tax and other incentives to attract investment; and infrastructure sufficient to support efficient manufacturing operations and exports. (Lieberthal and Lieberthal, 2004: 3-4) Read more

Chapter 5: Irish FDI In China ~ Evidence, Potential And Policy ~ Irish Investment In China. Setting New Patterns

Introduction

Introduction

Having set out the locational advantages and disadvantages which China possesses, this chapter will explore the non-applicability of Irish FDI in China to Barry et al‘s (2003) model for developed economies, and will attempt to explain why there is such a divergence. It can be argued that there is a view which equates outward FDI with the re-location of jobs abroad. In order to address this perception, the effects of outward FDI on the home economy will be explored. Acknowledging that our sub-hypothesis holds and that the investment climate in China is different from that faced by Irish investors in developed economies, we will explore our prescriptive research question, namely the role which exists for government in supporting potential investors who wish to enter the Chinese market.

Barry’s Model

Barry et al’s (2003) model states that Irish outward FDI is disproportionately horizontal in nature and oriented towards non-traded sectors. This model is based on an analysis of Irish FDI in the traditional destinations for Irish FDI, namely the US and UK, both of which are developed economies. This research analysed Irish FDI in China, a developing economy. While accepting the limited nature of this research, it was found that 82% of FDI is in the traded sector and only 18% in the non-traded sector. It can be said, therefore, that this finding is at variance with the model for developed economies, as set out by Barry et al (2003). Secondly, in relation to the horizontal or vertical nature of Irish FDI in China, this research identified 55% as being of a horizontal nature and 45% as being vertical. Barry et al’s model states that Irish traditional FDI in developed economies is “disproportionately horizontal in nature’. 55% could not be described as ‘disproportionately horizontal’. Accordingly, this finding also deviates from Barry et al’s model. Accepting the difficulty of measuring the true level of horizontal versus vertical FDI, as highlighted in the literature review, the figure of 55% is below the level of 70% which Moosa (2002) contends may be the general order of horizontal FDI. This points to the level of horizontal Irish FDI in China being somewhat lower than the norm and not as strong as would have been anticipated had it been in accordance with Barry et al’s model.

We can say that this research indicates that the current wave of Irish FDI in China is predominately in the traded sector and marginally horizontal in nature.

Accepting that the sample size for this research is limited, it is nevertheless an accurate reflection of current investment patterns by Irish MNEs in China.

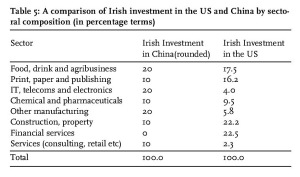

Table 5: A comparison of Irish investment in the US and China by sectoral composition (in percentage terms)

Irish FDI in China and Barry’s Model

It is also interesting to examine whether the limited Irish investment in China diverges or conforms to the sectoral composition identified by Barry et al (2003) for developed economies. Using the categorisation of Irish investment in the US put forward by Barry et al (see table 3 in previous chapter), the following comparisons can be made (Table 5):

The percentage for food, print and chemicals is not greatly different between both categories. IT, telecoms and electronics are considerably more important in the case of China. Significant deviations can be identified in ‘other manufacturing’, financial services and construction to a lesser degree. Notably, the Irish financial service sector is absent from China. Again acknowledging the small sample size of this research, current Irish investment trends into China show a divergence from patterns identified for investment in the US.

Why then does Irish FDI deviate from Barry et al’s model and also diverge in sectoral composition from that identified in traditional destinations for Irish outward FDI? There may be several possible explanations.

Recalling that firms invest abroad because they possess ownership and internalisation advantages, Barry et al (2003) suggest that R&D and superior product differentiation through advertising are generally found to be the most important firm-specific assets associated with multinationality; but Irish MNEs do not appear to follow the standard pattern associated with multinationality. Instead, they propose that the predominant proprietary assets which Irish firms possess are in the fields of management and expertise, mainly in non-traded sectors. However, this research found that the composition of Irish MNEs investing in China is largely in the traded sector. It is possible, therefore, that because the expertise of Irish MNEs largely lies in the non-traded sector, this is inhibiting current levels of FDI in China, given the largely manufacturing and traded nature of the Chinese economy at this point in time.

Secondly, the structure of the Irish economy can be broadly defined as highvalue output with little high-volume low-value manufacturing. (This results from the relatively high cost structure of the economy, as compared with developing economies). While Barry et al point out that the Investment Development Path hypothesis is silent on the distinction between vertical and horizontal FDI, they claim that as production costs rise there is an incentive for domestic firms to engage in vertical FDI, moving labour-intensive components to countries with a locational advantage in low-cost labour. This opportunity was identified by a very limited number of Irish MNEs. While China’s low wage cost environment may facilitate some Irish investment, market opportunity remains the primary investment objective. Read more

Chapter 6: Conclusions & Bibliography ~ Irish Investment In China. Setting New Patterns

Introduction

Introduction

Based on research undertaken on Irish outward FDI into the US and UK, both of which are developed economies, Barry et al conclude that Irish FDI is disproportionately horizontal and oriented towards non-internationally traded sectors. As China is now the largest global recipient of inward FDI, and is a developing economy, research was undertaken among all Irish MNEs which have invested in China to ascertain if current Irish FDI into China conforms to the model identified in the case of Irish FDI into the US and UK. Accepting that the level of Irish FDI in China is at a relatively low level, the value in considering this hypothesis is that Irish FDI in China will presumably increase, given China’s pre-eminent role in inward FDI.

While there are several investment theories, Dunning’s eclectic paradigm was chosen as the optimal framework within which to conduct this research, as it facilitates simultaneous analysis of the advantages enjoyed by both the MNE and the host economy.

Desk-based research and semi-structured interviews were conducted to explore the nature of Irish FDI in China. The decision to use semi-structured interviews to obtain data on the perceptions of executives can be considered appropriate, as the executives provided rich data on the rationale underlying the investment decision and the locational advantages and disadvantages which China poses.

Executives of non-Irish MNEs which have invested in China were interviewed in addition. The inclusion of non-Irish MNEs provided an opportunity to corroborate the views of executives of Irish MNEs and provided a broader pool of expertise from which to gather perceptions on the locational advantages and disadvantages which China poses for investors. Executives from Irish MNEs which have invested in Eastern Europe were interviewed separately to gain an understanding of why the level of Irish FDI into China is relatively low.

Main Findings

Barry et al (2003) analysed the nature of Irish outward FDI and observed an increasing level of Irish outward FDI. The main destination for this FDI is developed economies, particularly the US and the UK. It is suggested that Barry et al made a significant contribution to the research into Irish outward FDI by their identification of Irish outward FDI as being disproportionately horizontal and oriented towards non-internationally traded sectors. This research builds on their model and extends the knowledge of Irish outward FDI by examining the nature and scope of Irish FDI into China, a developing economy. The value in studying FDI in China lies primarily in its status as the principal recipient of inward FDI globally. Since the introduction of the ‘opening-up’ policy in 1979, economic reforms in China have created an increasingly favourable climate for inward FDI. However, considerable challenges still remain with inadequate legal protection and challenges to intellectual property rights.

But Beijing’s desire to expand the service and private sectors, combined with its willingness to allow foreign firms to compete nearly across the board, means that the China market is now becoming a real opportunity just as the purchasing power of Chinese consumers is beginning to increase. And China is likely to remain the world’s fastest growing major economy for the coming decade and beyond …Understanding how to do well in China and with Chinese resources will become a critical component in a global competitive strategy. (Lieberthal and Lieberthal, 2004: 11)

In order to deepen our understanding of the nature of Irish FDI and specifically the nature of Irish FDI in the largest global recipient of inward FDI, this research has examined the hypothesis that the nature of Irish outward FDI, as identified by Barry et al, varies in the case of China. This research has contributed to our understanding of Ireland’s investment development path by introducing a study of Irish outward FDI in a developing economy for the first time. Read more

Worldbank ~ Violence In The City : Understanding And Supporting Community Responses To Urban Violence

This study aims to understand how urban residents cope with violence, or the threat of it, in their everyday lives, to inform the design of policies and programs for violence prevention. The study is the first global study on urban violence undertaken by the World Bank and covers three regions. It emerged from the growing demand within the Bank and client governments for a more comprehensive understanding of the social dimensions of urban violence. The study is not an exhaustive review of the topic, but rather is an exploration of the social drivers of violence, and its impact on social relations. The report consists of six chapters. In chapter one, the topic of urban violence is introduced as a pressing development issue. Chapter two discusses the complex relationship between cities and violence. In chapter three, the report reviews the literature to develop an analytical framework for understanding community capacities for violence prevention. Chapter four reviews interventions to prevent violence in terms of their impact on these key community capacities. The empirical findings from the five case studies are presented in chapter five, followed by strategic policy orientations in chapter six.

Read more: http://documents.worldbank.org/violence-city