Purifying Islamic Equities ~ The Interest Tax Shield

Abstract

This paper seeks to add to the debate regarding the appropriate methodology to purify tainted components from shari’ah compliant equities. Based on the Qur’anical prohibition against riba and an analysis of the purification methodology recommended by AAOIFI Shari’ah Standard 21, this paper highlights shortcomings in Standard 21 and references the corporate finance literature to argue for the need to also purify the interest tax shield from debt. Purification is a pivotal element of the Islamic investment process yet Standard 21 permits a loose interpretation which causes portfolios to be under-purified. Standard 21 also makes no mention of the interest tax shield from debt even though the benefits there from are at odds with the principles of social justice in Islam. That there is no mention of the interest tax shield from debt in the (limited) literature on the purification of Islamic equities is puzzling. This paper has implications for the Islamic funds industry as well as for compliant Muslim investors.

Introduction

The Islamic funds industry is estimated at 5.5 per cent (Ernst & Young, 2011) of the over $1.0 trillion (Wilson, 2009) global Islamic finance industry. Although small in comparison with the conventional funds industry, the potential growth from targeting the largely untapped Muslim market (estimated at 23 per cent of the world’s population) has garnered significant attention (Hassan and Girard, 2011). But the nascent Islamic funds industry is already at a crossroads. There are a number of issues which could derail its early promise – chief among these is confusion about how to purify Islamic portfolios to ensure shari’ah compliance.

Purification refers to the need to quantify and donate to charity all impure components deemed unacceptable under shari’ah principles and teachings (Elgari, 2000). Impure components include riba, which in modern Islamic finance has become synonymous with interest-related activity and is unequivocally prohibited in the Qur’an. Because nearly every company in the world receives/pays interest on its cash/debt balances, the practical effect of an absolute interpretation of the prohibition against riba is that the funds industry is, ipso facto, off limits for Muslim investors (Moore, 1997; McMillen, 2011). As a result, the shari’ah Supervisory Boards (hereafter SSBs) that determine the compliance of any investment have had to make a number of compromises to allow some permissible variation from absolute shari’ah principles. While some research has been done relating to the construction and application of Islamic stock screens, there is a paucity of literature about how haram elements resulting from permissible variation should be purified.[i],[ii] Although the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) recommends one method for purging impure amounts in Shari’ah Standard 21 Financial Papers (Shares and Bonds) (hereafter S21), the terminology used throughout is not consistent and, in certain sections, lacks specificity. Also, not all jurists adhere to AAOIFI standards such that several methods are used in practice. The result is that, even for those adhering to AAOIFI standards, differing interpretations are possible, meaning that confusion remains and haram components go unpurified. To some shari’ah scholars, the entire permissibility of an Islamic fund hinges on purification, so this lacuna needs to be addressed (Elgari, 2000).

This paper discusses the unequivocal prohibition against riba in the Qur’an and the hadith, and its impact on commercial activity in the Islamic world. It documents how the practice of permissible variation has evolved in the Islamic funds industry to allow a degree of deviation from absolute concepts and analyses some of the various current methodologies suggested for purging the consequent impurities from Islamic portfolios, with a focus on S21. Given what is at stake for the nascent Islamic funds industry, this chapter also suggests a comprehensive methodology for the purification of prohibited components which includes the need to also purify the benefits from the interest tax shield from debt −the benefits of which to the firm are well understood in the corporate finance literature.

Islam and Commercial Activity

Islam is a complete way of life, a lifestyle which constitutes a part of every Muslim’s cultural and spiritual identity (Abbasi, Holman,andMurray, 1989; DeLorenzo, 2002). Islam aims at striking a balance between individual freedoms (including commercial activities, Qu’ran 62:10) and ensuring that these freedoms are conducive to the growth and benefit of society at large (Ebrahim, 2003). Indeed, the Qur’an and the Sunnah (Islamic custom and practice) place tremendous stress on justice. All leading jurists therefore, without exception, have held that justice is a central indispensable ingredient of the maqasid al-shari’ah, or the goals of Islam (Chapra, 2000). In economics, justice can be interpreted to mean that resources are used in a manner that ensures, inter alia, the equitable distribution of income and wealth and economic stability (Chapra, 2000). Since the emergence of post-independence Muslim states in the global economy in the 1960s, there has been much debate about how commercial activity, and for this chapter the Islamic funds industry specifically, can be organized to conform to Islamic justice and shari’ah. Chapra (2000) contends that these goals cannot be realized without a humanitarian strategy which injects a moral dimension into economics — the prohibition against riba is part of this moral dimension.

The Prohibition against Riba

Riba in shari’ahtechnically refers to the premium that must be paid by the borrower to the lender together with the principal amount as a condition for the loan or for an extension of its maturity (Chapra, 1986). Riba is prohibited in the Qur’an−a popular translation of the Qur’an (Al-Baqarah) translates key verses pertaining to riba(2:278–279) as:

278. “O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers.

279. “And if you do not, then be informed of a war [against you] from Allah and His Messenger. But if you repent, you may have your principal −[thus] you do no wrong, nor are you wronged.”

Karsten (1982) explains that riba is prohibited because it reinforces the tendency for wealth to accumulate in the hands of a few (i.e. it works against social justice), and thereby diminishes human beings’ concern for their fellow people. Based on the strict application of the Qur’anical prohibition, it is not permitted for compliant Muslims to be involved with riba in any way, shape or form −a hadith narrated by Abu Dawud states that “The Messenger of Allah cursed the one who devours riba, the one who pays it, the one who witnesses it, and the one who documents it”.

Despite the universal agreement about the unequivocal prohibition against riba, it is also broadly agreed that the Qur’an does not provide a detailed explanation of what exactly constitutes riba (Ahmad and Hassan, 2007). At the time of the revelation of the verses about riba, the only type of riba known was ribaal-nasi’ah (pertaining to the application of an exploitative, exorbitant, or penal rate of interest). Over time, with the growth of global economic activity and the development of new methods of trade and commerce, this narrow definition of ribahas been broadened based on hadith − The Fiqh Academy of the Organisation of Islamic Conference (OIC) has condemned all interest-bearing transactions as void (Al-Omar and Abdel-Haq, 1996). The objective served by this broadened definition of riba is not only the avoidance of injustice of interest when interest is exploitative or penal but the avoidance of injustice of interest in all its forms. Any material benefit above the capital sum lent is prohibited such that economic credit is most definitely riba (Ahmad and Hassan, 2007).

Permissible Variation

In the conventional financial sector, financial intermediation is effected through lending and the time value of money is reflected in interest payments such that publicly listed companies operating within this system are inescapably contaminated by either the payment or receipt of interest (and usually both simultaneously). Since riba has become synonymous with bank interest, compliant Muslims are concerned about whether investing in equities is lawful. Obviously, if the absolute shari’ah prohibition against riba is applied (along with other shari’ah based restrictions), the pool of permitted equities would be too small for any reasonable diversification to be possible and investment in equity markets would, to all intents and purposes, be off limits for compliant Muslims (Wilson, 2004).[iii]

This fundamental impasse has motivated compromise by jurists to allow broad-based equity participation within shari’ah limits. These compromises are symptomatic of a new impetus in the geo-economics of the Islamic world over the past 20 years, referred to as “The Metamorphosis Period” (Haniffa and Hudaib, 2010). For example, the AAOIFI was set up in 1991 to prepare accounting, auditing, governance, ethics, and shari’ah standards for Islamic financial institutions (IFIs). Despite the fact that for most IFIs these standards are not mandatory, the AAOIFI has been successful in promoting its standards to IFIs globally (Kamla, 2009), which contributes to legitimizing the financial products that incorporate these standards as Islamic to the Muslim public (Kuran, 2004; El-Gamal, 2006).

The AAOIFI has used a variety of adaptive mechanisms such as Ijtihad (reasoning and argumentation), urf (local custom), and darura (necessity) to, legitimize innovation and the modernization of the Islamic finance industry. The result has been a collaboration of interested parties that has laid the foundations for, and instigated the development of, shari’ah-compliant products to enable IFIs to compete with their traditional Western interest-based counterparts and has meant that the Islamic finance industry has been transformed to compete on the global financial stage. The end result for compliant Muslim investors is that, within shari’ah limits and subject to purification, an investment programme has been developed to permit investment in common equity shares, i.e. absolute application has been replaced by permissible variation (Elgari, 2000).[iv]

Purification in Practice

Purification is therefore a crucial element in the Islamic investment process. Indeed, Elgari states that “no part of [the Islamic investment process] is on more solid ground from a shari’ah point of view, than that of purification” (2000, p.2). If permissible variation is the “quid” of the Islamic funds industry, then purification is the “proquo”. A problem for the Islamic funds industry is that while there is some research on the construction and application of Islamic stock screens used to deem companies as Islamically acceptable, there is a paucity of literature on the pivotal purification element to explain how forbidden elements of these acceptable companies should be purged.[v] This is because the purification process is difficult and the result is that there is no consensus about what is best purification practice; consequently,there are a number of methods used in practice (Elgari, 2000). The most common methods used can be grouped into the “dividend” and the “investment” methods (Ayub, 2007).

One issue in relation to these methods is whether the amount to be purified is purified before or after tax to the holder of the shares. Obviously, allowing the application of a tax rate on tainted amounts will lower the amount needed to be purified. While after-tax amounts are often used in practice, Clause 3/4/5/5 of Standard 21 stipulates that:

“It is not permitted to utilise the prohibited component in any way whatsoever nor is any legal fiction to be created to do so even if this is through the payment of taxes.”

This clause is itself based on the the hadith narrated by Abu Huraira who said that the Prophet said: “Allah . . . is pure and accepts only that which is pure”. Therefore, per S21, the compliant Muslim investor cannot derive any benefit, including the payment of taxes of any kind, from the prohibited components. This includes permitting the company to pay corporate taxes with the prohibited component in the investor’s name − prohibited components must be purified in full.

Another issue for these methods is whether the amount to be purified is pre- or post-distribution (i.e. dependent on the dividend pay-out ratio). The dividend method focuses on post-distribution amounts requiring that only dividends distributed to investors (i.e. dividended income) need to be purified; capital gains, as the argument goes, are a market element not requiring purification. Obviously, this method is problematic for investors in companies which, though deemed shari’ah complaint per the application of Islamic stock screens by SSBs, generate some riba gains but do not pay dividends. Finance theory explains how, by retaining some or all of the company’s earnings, a company is simply reinvesting unpurified elements in the investor’s name. This is unacceptable from a shari’ah perspective. The investment method focuses on pre-distribution amounts, i.e. on dividendable rather than dividended income. By focusing on the company’s ability to generate returns rather than the distribution of those returns, the investment method is (versus the dividend method) more comprehensive. S21 (Clause 3/4/5/4) prescribes a methodology for purifying haram amounts as follows:

“The figure . . . is arrived at by dividing the total prohibited income of the corporation whose shares are traded by the number of shares of the corporation, thus, the figure specific to each share is obtained. Thereafter the result is multiplied by the number of shares owned by the dealer — individual, institution, fund or another — and the result is what is to be eliminated as an obligation.”

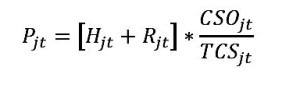

This favours the investment method over the dividend method (Ayub, 2007). S21 is clear −all prohibited components should be purified when they are generated by the company rather than when they are received by the investor. Diminishing an obligation to purify prohibited components via the application of the payout ratio or the corporate tax rate is not allowed. The clarity on this issue has the additional benefit that personal tax rates on dividends and the additional calculations this causes do not have to be considered in this chapter (Graham, 2003).[vii] Therefore, the total haram amount to be purified, from the shares owned by an investor of any company j in year t, is calculated as:

(1)

where H is the pre-tax haram amounts from operations, R is the pre-tax haram amounts from riba, CSO is the number of common shares owned by the investor, and TCSis the total number of common shares outstanding.

Another area of confusion is in the determination of the specific riba amounts that need to be purified. Insofar as S21 can be viewed as best practice recommendations, this confusion is demonstrated by reference to a “prohibited component” is Clauses 3/4/4 and 3/4/5/5 and “total prohibited income” in Clause 3/4/5/4. Because of the unequivocal Qur’anical prohibition against riba, “prohibited component” implies that riba in all its forms (interest expense as well as interest income) needs to be purified. This is in line with the hadith narrated by Al-Asqalani, al-Hafiz Ahmad IbnHajar, where he says that the Prophet said that “every loan that attracts a benefit/advantage is riba”. “Prohibited income”, on the other hand, implies that only riba from interest income matters. Focusing on interest income alone (as is common in practice) seems an obviously correct step because allowing investors to net interest expenses paid from interest income received appears to be directly in opposition to the goal of purging riba amounts in full. This is based on the logic that anything that causes a reduction in the amount of haram components to be purified (i.e. taxes, as previously discussed), even if it is itself riba (i.e. interest expenses), should be ignored (Elgari, 2000). However, what remains in question, and the specific focus of this chapter, is at what point in the purification process should interest expenses be ignored.

The Interest Tax Shield

The value of the interest expense tax shield is well documented in the corporate finance literature. The interest tax shield arises because interest on debt is tax-deductible, such that by taking on debt (i.e. leverage) a company can reduce its tax bill. Chapra extends the definition of riba discussed previously, stating that “[r]iba represents, in the Islamic value system, a prominent source of unjustified advantage” (1984, p.1). Since the interest tax shield is a way to keep cash flows that would otherwise have been paid as tax, it represents a real gain for investors and is a riba amount that can be estimated for any company, j, in any year, t, as:

(2)

where X is interest expense paid and τ is the marginal corporate tax rate, meaning that the product of the two is the tax that is saved by company j per dollar of interest expense paid in year t.

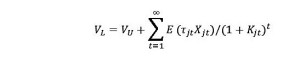

Cooper and Nyborg (2006, p. 224) have shown conclusivelythat the value of the tax shield is a crucial aspect of corporate valuation according to the equation:

Where VL is the value of a levered company, VU is the value of an unlevered company, E(.) is the expectations operator, and K is the discount rate appropriate for the tax saving for any company, j, in any year, t.[vii] One of the criticisms of estimating the value of tax shields per equation (3) is that, due to the lack of visibility regarding corporate tax rates in the future, there is uncertainty about the appropriate discount rate for those tax shields (Cooper and Nyborg, 2007), as well as about whether interest will continue to be tax deductible in perpetuity (De Mooij, 2011), and so their estimation is not reliable with any degree of certainty. However, all that is required for the purification of any company’s equity in the most recently reported year is historical information,so any problems caused by the expectations operator and the appropriate discount rate, Kjt, in equation (3) are moot, i.e. the value of the interest tax shield in the most recently reported year can be calculated with relative ease per equation (2).

From a practical perspective, it is argued that the debt bias induced by the tax deductibility of interest expense has an insipid detrimental impact on the whole society via the erosion of the corporate tax base (De Mooij, 2011). While it is the general view of experts that the debt bias was not a major cause of the financial crisis (Lloyd, 2009; Slemrod, 2009; Keen, Klem, and Perry, 2010; Hemmelgarn and Nicodeme, 2010), by contributing to the excessive leverage of firms, it might well have deepened the crisis. Chapra (2000) argues that by subjecting dividend payments to taxation while allowing interest payments to be treated as a tax deductible expense, the tax system indirectly promoted the use of debt over equity, encouraged the excessive build-up of public and private debt, and contributed to the volatility of financial markets. Indeed, arising from concerns about the debt bias causing companies to take on too much risk and the subsequent detrimental impact this can have on society in general, a number of countries have imposed thin capitalization rules which limit the tax deductibility of interest expense.

Another practical criticism of debt bias is that the financial system from which the debt is sourced tends to reinforce the unequal distribution of capital (Bigsten, 1987). The Qur’an maintains that wealth should not be concentrated and mobilized in the hands of a few individuals (Kamla, 2009), warning that such wealth mobilization engenders social imbalances (Qur’an, 59:7) (Gambling and Karin, 1991). Indeed, Abu Yusuf advising Caliph Harun Al-Rashid proclaimed that rendering justice to those wronged and eradicating injustice raises tax revenue [and] accelerates development. In light of these proclamations the interest tax shield could be seen as facilitating, and even encouraging, the unequal distribution of capital, income, and wealth and perpetuating injustice.

Obviously the tax deductibility of interest and the interest expense tax shield were not in existence at the time of the Prophet and so it is the sources of shari’ah other than the Qur’an that will determine its permissibility for compliant equities. Iqbal (2008) explains that the principle for determining the permissibility of something is that if it adds to the overall welfare of society and does not contradict any other settled act or issue in the Qur’an and the hadith, then it should be deemed permissible; otherwise, if either or both of these conditions are not met, it should be declared impermissible. Cooper and Nyborg (2006) have shown that all of the benefit of debt for companies is in the value of the interest tax shield such that not only does debt bias directly decrease the overall welfare of society by eroding the tax base and facilitating the unequal distribution of wealth, but the existence of the interest tax shield also indirectly jeopardizes the long-term welfare of society by encouraging companies to take on too much risk (DeMooij, 2011). In the absence of a settled act or issue in the Qur’an or the hadith to suggest the contrary, the interest tax shield and the riba components generated therefrom would appear to be impermissible and requiring purification.

Therefore, it is the contention of this paper that interest expenses should be ignored only after the benefit of the tax shield arising therefrom has been accounted for such that the appropriate riba amount to be purified is:

![]()

(4)

where I is pre-tax interest income received and other variables are as previously defined. By including equation (4), equation (1) can then be modified so that the total amount to be purified from all haram sources generated by the company is given by:

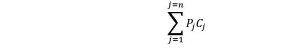

That is, haram elements should be purified in full, before tax, and include the interest tax shield. This formula can be easily extended from the individual equity to the portfolio level. That is, assuming a compliant Muslim investor has a portfolio of companies,, then the total amount to be purified from the portfolio is given by:

Summary and Conclusion

If the Islamic funds industry is to follow through on its early promise to become accepted permissible practice among Muslim investors, then any suspicion as to its Islamic nature needs to be assuaged. The development of Islamic accounting standards and regulations by the AAOIFI goes some way towards achieving this, essentially legitimizing Islamic finance, banking, and the funds industry. But adherence to AAOIFI standards is not mandatory and it is argued that the industry departs from the holistic Islamic principle of social justice, leaving a gap between the claims of the industry and what is delivered to compliant Muslim investors (Kamla, 2009). It is important, if not essential, then, that balanced as it is precariously between secular goals and sacred intentions, the industry is seen to abstain from what is doubtful in favour of what is clear. That is, in sofar as permissible variation is tolerated at all, maximum effort should be made to purify all tainted components (Maurer, 2002; El-Gamal, 2006).

While the recommendations in S21 are a significant contribution in this regard, the lack of agreement among SSBs in practice about the need to purify even seemingly obvious and unequivocally prohibited elements is a concern. It is hardly surprising then that, to the best of this author’s knowledge, no consideration has been given to the need to also purify benefits to investors generated by the interest tax shield. Perhaps it has been previously considered and rejected as an overly conservative step too far. If this is the case, then the literature is silent with the exception of Pomeranz who, perhaps knowingly, comments that purification is “more easily done with interest income than interest expense” (1987, p.125).

At the very least, the need for the interest tax shield to be purified is worthy of consideration since, according Abu Dawud, one of the sayings of the Prophet which summarises Islamic Law is that which is lawful is clear, and that which is unlawful likewise, but there are certain doubtful things between the two from which it is well to abstain (Kishna, 2010). If the benefit to investors from the interest tax shield is not immediately obviously forbidden as a benefit from riba activity, then it certainly seems to qualify as doubtful. This is a non-trivial point for Muslim investors who want to abide by the guidance of Islam and be convinced that nothing prohibited (haram) is made permissible (halal). While it can be argued that, in certain circumstances, the information required to calculate the gains from the interest tax shield (i.e. a breakdown of interest income and interest expense rather than just a net value) might not be available, for most companies this is not the case, and for others some basic assumptions can achieve the same goal. That is, if comprehensive purification based on Islamic principles is the aim then minor impediments should not be used as an excuse, a priori, not to achieve that goal. In addition, at a much more fundamental level, it has been shown that the debt bias caused by the tax deductibility of interest expense erodes the tax base, encourages the unequal distribution of capital, income, and wealth, encourages risk-taking behaviour, and perpetuates injustice in society. In short, it can be argued that, by failing to meet the moral duty to achieve benefit for all Muslims (Moore, 1997), the interest expense tax shield is also doubtful on the grounds of social justice.

The adoption and amendment of shari’ah standards by the AAOIFI is not done lightly. It is a painstaking, diligent, and precise elucidation process to determine if, how, and when concepts should find application (McMillen, 2011). There is a constant, healthy tension in the process between undue expansion of the concepts and pragmatic implementation so as to advance the development of the Islamic finance industry. This paper attempts to add to the debate on this topic regarding the appropriate steps to be undertaken to comprehensively purify tainted components that arise in shari’ah compliant portfolios as a result of permissible variation, up to and including the interest tax shield. The observations in this paper are inclined to facilitate the legitimacy of the Islamic funds industry in the minds of Muslim investors by engendering conservatism at the margin and leaving no room for loose interpretation or the acceptance of any doubtful components.

NOTES

[i] In Islamic Jurisprudence, haram is used to refer to any act that is forbidden and operates as a dichotomy with halal, which denotes the permissible.

[ii] See Derigs and Marzban (2008) for a comprehensive discussion of the application of Islamic stock screens.

[iii] The difficulty in sourcing suitable Islamically qualified companies is apparent from a study by Al-Baraka Islamic Bank, which identified only 560 companies as “compliant” from a potential pool of 19,000 (O’Sullivan, 1996).

[iv] The specification that the shares be common shares is to exclude preferred shares, which are hybrid debt/equity securities that provide a guaranteed return; investing in a company’s preferred shares or its bonds is not permitted. Common shares were approved as an instrument for investment by the Council of the Islamic Fiqh Academy in 1993 (Forte and Miglietta, 2007).

[v] For a comprehensive analysis of how shari’ah limits are used by SSBs to create and apply Islamic stock screens, see Derigs and Marzban (2008).

[vi] If applied, personal tax rates will lower the amount to be purified further. Nisar (2009, p.1) comments that when various methods are used in combination, the purification process often appears “to be window dressing, whereby . . . a small amount of income is purged to solace the conscience of the shari’ah compliant investor”.

[vii] This basic relationship also satisfies the approaches used by Modigliani and Miller (1963), Miles and Ezzell (1980, 1985), and Ruback (2002) to the value of the tax shield, although these studies make different underlying assumptions.

References

AAOIFI, 2010. Accounting, auditing and governance standards (for Islamic financial institutions). English version. Manama: AAOIFI.

Abbasi, S.,Hollman K., and Murray, J., 1989. Islamic economics: foundations and practices. International Journal of Social Economics, 16(5), pp. 5–17.

Ahmad, A. U. and Hassan, M. K., 2007. Riba and Islamic banking.Journal of Islamic Economics, Banking and Finance, 3(1), pp. 1–33.

Al-Omar, F. and Abdel-Haq, M., 1996. slamic banking: theory, practice &challenges. Karachi: Oxford University Press.

Ayub, M., 2000. Understanding Islamic finance. Chichester: Wiley.

Bigsten, A., 1987. Poverty, inequality and development. In: N.Gemmell, ed. Surveys in development economics.Oxford: Blackwell. pp. 135–171.

Chapra, M. U., 1984. The nature of riba in Islam. Hamdard Islamicus, 7(1), pp. 3–24.

Chapra, M. U., 1986. Towards a just monetary system.Leicester: The Islamic Foundation.

Chapra, M. U., 2000. Why has Islam prohibited interest? Review of Islamic Economics, 9, pp. 5–20.

Cooper, I. A. and Nyborg, K. G., 2006. The value of tax shields IS equal to the present value of tax shields. Journal of Financial Economics, 81(1), pp. 215–225.

Cooper, I. A. and Nyborg, K. G., 2007. Valuing the debt tax shield. Journal of Applied Corporate Finance, 19(2), pp. 50–59.

DeLorenzo, Y. T., 2002. The religious foundations of Islamic finance. In: S. Archer and R.A. Karim, eds. Islamic finance, innovation and growth. London: Euromoney Books and AAOIFI. pp. 9–28.

DeMooij, R. A., 2011. Tax biases to debt finance: assessing the problem, finding solutions. Available at: <http://www.imf.org/external/pubs/ft/sdn/2011/sdn1111.pdf>[Accessed on 21 October 2013].

Derigs, U. and Marzban, S., 2008. Review and analysis of current shar’iah-compliant equity screening practices.International Journal of Islamic and Middle Eastern Finance and Management, 1(4), pp. 285–303.

Ebrahim A. F., 2003. The importance of Islamic banking for Muslim minorities.[online]. Available at: <http://www.fatwa.org.za/OtherIIslamicSections/IslamicEconomics> [Accessed on 16 January 2012].

El-Gamal, M. A., 2006.Islamic finance, law, economics and practice.Cambridge: Cambridge University Press.

Elgari, M. A., 2000. Purification of Islamicequity funds: methodology and shari’ah foundation. Proceedings of the Fourth Harvard University Forum on Islamic Finance.Harvard University, Cambridge (MA), U.S.

Ernst & Young, 2011. Islamic funds & investments report. Dubai: Ernst & Young.

Forte, G. and Miglietta, F., 2007. Islamic mutual funds as faith-based funds in a socially responsible context. Available at: <http://boa.unimib.it/bitstream/10281/15210/3/Islamic%20mutual%20funds%20as%20faith-based%20funds.pdf>[Accessed on 21October 2013].

Gambling, T. and Karim, R. A., 1991.Business and accounting ethics in Islam. London: Mansell Publishing Limited.

Graham, J., 2003. Taxes and corporate finance: a review. Review of Financial Studies, 16, pp. 1075–1129.

Haniffa, R. and Hudaib, M., 2010. Editorial: Islamic finance – from sacred intentions to secular goals? Journal of Islamic Accounting and Business Research, 1(2), pp. 85–91.

Hassan, M. K. and Girard, E., 2011. Faith-based ethical investing:the case of Dow Jones Islamic indexes.[online]. Networks Financial Institute Working Paper No. 2011-WP-06. Available at: <http://indstate.edu/business/NFI/leadership/papers/2011-WP-05_Hassan.pdf>[Accessed on 21October 2013].

Hemmelgarn, T., and Nicodème, G., 2010. The 2008 financial crisis and tax policy. Working Paper 20. Brussels: European Commission Directorate-General for Taxation and Customs Union.

Iqbal, M. M., 2008. A broader definition of riba.[online]. Available at: <http://www.pide.org.pk/pdf/psde%2018AGM/A%20Broader%20Definition%20Of%20riba.pdf> [Accessed on5 January 2012].

Kamla, R., 2009. Critical insights into contemporary Islamic accounting. Critical Perspectives on Accounting, 20, pp. 921–932.

Karsten, I., 1982. Islam and financial intermediation. IMF Staff Papers, 29(1), pp. 108–142.

Keen, M., Klemm, A., and Perry, V., 2010. Tax and the crisis. Fiscal Studies, 31, pp. 43–79.

Krishna, A., (2010) ‘Sayings of Prophet Muhammad’, Anand Krishna Blog, 26 February. Available at: <http://www.peacenext.org/profiles/blogs/sayings-of-prophet-muhammad> (Accessed 21 October 2013).

Kuran, T., 2004.Islam and mammon: the economic predicaments of Islamism. Princeton: Princeton University Press.

Lloyd, G., 2009. Moving beyond the crisis: using tax policy tosupport financial stability. Mimeo. Paris: OECD.

Maurer, B., 2002. Anthropological and accounting knowledge in Islamic banking and finance: rethinking critical accounts. Journal of the Royal Anthropological Institute, 8, pp. 645–667.

McMillen, M. J., 2011. Islamic capital markets: market developments and conceptual evolution in the first thirteen years.[online]. University of Pennsylvania Working Paper Series.Available at: <http://ssrn.com/abstract=1781112>[Accessed on 21October 2013].

Miles, J. and Ezzel, J. R., 1980. The weighted average cost of capital, perfect capital markets, and project life: a clarification. Journal of Financial and Quantitative Analysis, 15, pp. 719–730.

Miles, J. and Ezzell, J. R., 1985.Reformulating the tax shield: a note. Journal of Finance, 40, pp. 1485–1492.

Modigliani, F. and Miller, M. H., 1963. Corporate incomes taxes and the cost of capital: acorrection. American Economic Review, 53, pp. 433–443.

Moore, P., 1997. Islamic finance, a partnership for growth. London: Euromoney Books.

Nisar, S., 2009. Purging of impure income: an appraisal of current shari’ah practices. Dow Jones Islamic Market Indexes Quarterly Newsletter.New York: Dow Jones.

O’Sullivan, D., 1996. New launches fill a gap in the market. Middle East Economic Digest, 40(28), pp. 10–11.

Pomeranz, F., 1997. The accounting and auditing organization for Islamic institutions: an important regulatory debut. Journal of International Accounting, Auditing and Taxation, 6(1), pp. 123–130.

Ruback, R. S., 2002. Capital cash flows: asimple approach to valuing risky cash flows. Financial Management, 31, pp. 85–103.

Slemrod, J., 2009. Lessons for tax policy in the great recession.National Tax Journal, 62, pp. 387–97.

Wilson, R., 2004. Capital flight through Islamic managed funds. In:C.M. Henry and R. Wilson,eds.The politics of Islamic finance. Edinburgh: Edinburgh University Press.pp. 129–152.

Wilson, R., 2009. The development of Islamic finance in the GCC. London: The London School of Economics, Centre for the Study of Global Governance.

About the author:

Dr. Mark Mulcahy is a lecturer in finance at University College Cork where his primary research interests are in valuation, corporate governance, corporate finance, Islamic finance and private equity. He is published in international peer-reviewed journals including the British Journal of Management and Corporate Governance: An International Review.