The Single-Payer Breakthrough In California: Robert Pollin On The Economics Of Universal Care

No Comments yet On June 1, California senators voted to replace private health insurance with a single-payer system. Senate Bill 562, by State Senators Ricardo Lara and Toni Atkins, passed 23-14, and will now advance to the Assembly where the measure would require two-thirds vote in both chambers to become law.

On June 1, California senators voted to replace private health insurance with a single-payer system. Senate Bill 562, by State Senators Ricardo Lara and Toni Atkins, passed 23-14, and will now advance to the Assembly where the measure would require two-thirds vote in both chambers to become law.

Clearly, the June 1 vote by California senators is an initial step toward the adoption of a government-run universal health care system, but it already signifies a major political victory for progressives in this country, who have long advocated for a publicly funded health care system. The proposed measure, i.e., SB-562, was backed by an economic analysis undertaken by the Political Economy Research Institute (PERI) of the University of Massachusetts at Amherst. Its lead author, Distinguished Professor of Economics and Co-Director of PERI Robert Pollin, introduced the study at a capitol news conference a day before the State Senate vote — and it was undeniably instrumental in the passing of SB-562. Now that the first hurdle toward the replacement of private health insurance in California with government-run health care has been cleared, we asked Pollin to weigh in on the bill’s financial implications and its future. In the exclusive interview below, Robert Pollin discusses why a transition to a truly universal health care system makes economic sense for the state of California — and the country.

C. J. Polychroniou: Bob, could you start by briefly outlining the key features of SB-562 and tell us how you and PERI got involved in providing the financial analysis for the proposed measure?

Robert Pollin: SB-562, in its essentials, proposes a classic single-payer, or Medicare-for-All, health care system for the State of California. That means basically two things: First, everyone in California is guaranteed access to decent health care, regardless of their income level, where they work or whether they have a job at all. This principle is quite straightforward. It is the equivalent to the principle on which we operate public schools in the US. It is also the principle that operates for Medicare right now, covering everyone 65 and over. And second, [the bill provides that] private insurance companies are no longer permitted to offer health care coverage for residents of California.

The way I got involved is also simple: I was asked to get involved by RoseAnn DeMoro, who is the longtime executive director of the California Nurses Association and National Nurses United. In my view, the nurses’ union is the most progressive and innovative union in the US and probably the single most effective force for good in US mainstream politics today. So, when they asked me to get involved, it would have been very hard to say “no.” On top of that, I have worked with them for years now, on the issue of taxing Wall Street — i.e., the “Robin Hood Tax.” In all of my previous work with them, they have had total respect for my independence as a researcher. That is critical. They knew that, if I took this commission, I was doing it to produce a serious piece of analytic work. I was not about to just do cheerleading for them.

One of the major objections launched against SB-562 was that it would be financially unsustainable. However, the study that you and your colleagues undertook says providing universal coverage would increase overall system costs by about 10 percent, but the single-payer system could produce savings of about 18 percent. Can you elaborate a bit on this?

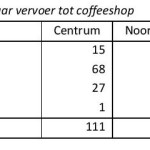

At present, the total cost of health care in California — including everything — is roughly $370 billion. But even with this level of spending — about 14 percent of total GDP in California — there is still about 7.5 percent of California’s population (2.7 million people) who have no health insurance, and another 36 percent of the population (about 12 million people) who are underinsured, i.e., they have limited access to health care because their insurance premiums, deductibles and/or co-payments are extremely high relative to their income levels. My co-authors James Heintz, Peter Arno and Jeannette Wicks-Lim and I estimated that to provide good health care to all those who are presently either uninsured or underinsured would raise total system costs to about $400 billion, assuming that the health care system remained intact otherwise. We then estimated that, with the single-payer system, we could extract about 18 percent in total cost savings. We get those savings through reducing excessive administration, controlling pharmaceutical prices, fixing fees for doctors and hospitals at Medicare rates, and reducing the high degree of waste in the present system of service provision (such as doctors ordering excessive procedures).

Through these cost-control measures, we estimate that the single-payer system can provide everyone in California with decent health care at a total cost of $330 billion, i.e., a savings of about 8 percent relative to the current system while still delivering universal coverage.

Adding new taxes is always a controversial issue with voters, so what type of taxes does the study propose to generate the revenue required to sustain a universal health care system in California?

Right now, federal, state and municipal financing covers about 70 percent of all health care expenditures in California. At present, federal law requires the federal government to continue providing the current level of spending even if a state organizes its own health care system differently than the prevailing federal law, which, to date, is still the Affordable Care Act (“Obamacare”). That means that the current public funding will cover about $225 billion of the total $330 billion in total spending needed to operate single-payer in California. We therefore still need to raise an additional $105 billion. To do that, we propose two new taxes: (1) a gross receipts tax on all California businesses of 2.3 percent, but with the first $2 million in business receipts exempted from the tax. This means that small businesses will pay no gross receipts taxes; (2) a 2.3 percent sales tax increase. This would exempt spending on housing, utilities and food. It would also provide a 2 percent income tax credit for low-income families who are now on MediCal (the California-based version of Medicaid).

Overall, both the gross receipts tax and the sales tax are quite progressive in their overall impact. Small businesses will pay nothing and most low-income families will pay nothing or only a very small amount.

There are close to 3 million uninsured residents in California today. What will be the impact of providing “free” health care coverage to them on the current expenditure level?

It will be transformative. They will have full access to health care for the first time. It will also save them money. For example, right now the average low-income family in California — including those receiving MediCal support — is paying around $700 per year in out-of-pocket costs for health care. These expenses will be gone.

What type of benefits will accrue for residents of California with the adoption of a universal health care system?

Under the California single-payer proposal, net health care spending for middle-income families falls sharply, to an average of 0.8 percent of these families’ income level. This represents a reduction in health care spending for California’s middle-income families of between 2.6 percent and 9.1 percent of income. By contrast, with California’s high-income families, health care costs will rise, but still only to an average of 0.6 percent of their average income level. At present, California’s high-income families are receiving a net subsidy of 1 percent of their income to support their health care coverage.

The Economic Analysis of the Healthy California Single-Payer Health Care Proposal (SB-562) does not expand into the question of how the transition from a private health care system to a universal one might affect employment and growth levels, but can you speculate on the possible impact that this might have on the economy for the state of California in general?

The Healthy California plan is actually a windfall for most businesses in California, because it frees these businesses from having to pay for health insurance and to manage these plans for their workers. True, they will have to now pay the 2.3 percent gross receipts tax on receipts over $2 million. Still, on balance, we find that all the representative firms of all sizes are at least no worse off through Healthy California relative to conditions with the existing system. In most cases, the firms [will] be significantly better off. Thus, small firms that have been providing private health care coverage for their workers will see their health care costs fall by 22 percent as a share of payroll. The small firms that have not provided coverage will still make zero payments for health care under Healthy California, since their average level of gross receipts falls well below the $2 million threshold for receiving a tax exemption.

Medium-sized firms will see their health care costs fall by between 6.8 and 13.4 percent as a share of payroll under Healthy California relative to the existing system. Even firms with up to 500 employees will experience a fall in their net health care costs of 5.7 percent as a share of payroll relative to the existing system. Finally, the largest firms in California, which employ an average of 1,143 workers and receive gross receipts, on average, of $487.3 million, will experience a decline in their health care spending of 0.6 percent as a share of payroll under Healthy California relative to what they presently pay.

Are you optimistic about the chances of the Healthy California Act being enacted? Also, what do you think progressives and California residents should do in the meantime to make sure that the concept of a single-payer system becomes a reality, and thus help the US move closer toward adopting a human health care system and be in line with the rest of the advanced industrialized world?

I was amazed that the California State Senate approved of the single-payer plan on Thursday, June 1, literally one day after we publicly presented our study. So that is certainly grounds for optimism. On the other hand, there is no avoiding the fact this measure represents a total transformation of a huge sector of California’s economy — 14 percent of the state’s GDP.

Moving from where we are at present, with one initial legislative victory, to full enactment of the proposal, then implementing the proposal in a way that really works for people, will entail many more difficult steps. But my impression is that the people of California are ready for this. According to the most recent polling evidence, 70 percent of California residents support single-payer. That level of support should certainly continue to get the attention of the state’s legislators as well as Governor Jerry Brown.

Copyright, Truthout. May not be reprinted without permission.

You May Also Like

Comments

Leave a Reply