Speaking Papiamentu ~ On Re-Connecting To My Native Tongue

03-07-2024 ~ It starts at Schiphol, the Amsterdam airport. Before that, I am still immersed in my life in Jerusalem, busy with family matters and with grassroots activism against the Israeli occupation, while under pressure to finish grant proposals for the multicultural Jerusalem feminist center and art gallery where I work. I do not have time to connect emotionally to my trip, which still feels more like a yearly obligation to visit my elderly mother in Curaçao, when I would rather spend my precious vacation time trekking in Turkey or Nepal.

03-07-2024 ~ It starts at Schiphol, the Amsterdam airport. Before that, I am still immersed in my life in Jerusalem, busy with family matters and with grassroots activism against the Israeli occupation, while under pressure to finish grant proposals for the multicultural Jerusalem feminist center and art gallery where I work. I do not have time to connect emotionally to my trip, which still feels more like a yearly obligation to visit my elderly mother in Curaçao, when I would rather spend my precious vacation time trekking in Turkey or Nepal.

I usually have a few hours to kill, not enough to take the train into Amsterdam and visit old friends, which I do on my return trip when I have almost twelve hours between planes. And so, I silently wander around the airport, feeling a little like a spy, as I do in Jerusalem when I hear Dutch tourists speaking on the street, not suspecting that I, who probably look like a local to them, would understand. Not identifying myself as a speaker of Dutch, I take in the talk, smiling to myself, my little secret.

Here, in transit at the airport – a liminal space par excellence – I sometimes pretend to be a total stranger and address the salesperson in English. Perhaps that has more to do with the fact that I have not yet woken up my slumbering Dutch, or do not want to give away my unfamiliarity with the currency and other taken-for-granted facts of daily life in the Netherlands.

Or perhaps it is my resistance to being taken for an “allochtoon” – that polite way they refer to the “not really Dutch,” who nevertheless hold Dutch citizenship – a category that groups together the mostly Moslem migrants and those of us, from the former Dutch colonies, blacks and whites alike. It is a label that had not yet been coined when my schoolteachers in Curaçao taught us to see Holland as our “mother country,” to sing Wilhelmus Van Nassauwe, the Dutch national anthem, on Queen Juliana’s birthday and to accept the Batavians, a Germanic tribe, as “our” ancestors. They say that when you count, you invariably give away your mother tongue – to this day I count not in Papiamentu, but in Dutch, so totally did I embrace the colonial language.

I was four when I learned Dutch in kindergarten. I remember the feeling of utter embarrassment when everyone expected me to speak Dutch with my cousins whose father was Dutch, and I ran away crying. I was losing the secure ground that Papiamentu provided, having to jump into the deep waters of a foreign language without a life-vest before I knew how to swim.

Very soon, however, I was speaking Dutch fluently, determined to excel in the language. I wanted to know it even better than the Dutch children whose parents came from Holland. I spoke Dutch with all my school friends, even though most of us spoke Papiamentu at home, including the handful of schoolmates from my own community, the Sephardic Jews who settled on the island in the seventeenth century, after fleeing the inquisition in Portugal and Spain.

In my elementary school days, the teachers forbade us to speak Papiamentu even in the schoolyard, claiming it was the only way to learn proper Dutch. And so, I read, wrote, and thought in Dutch – it became my first literary language, as Papiamentu was basically only a spoken language at that time. Now, as I write this in 2007, after forty-two years away from the Dutch speaking world, my Dutch gets rusty, until I find myself again surrounded by its sounds and it returns to me and becomes almost natural.

I roam around the halls of the airport’s immense shopping center, not quite knowing what I am looking for. It is rather busy at the camera counter – I realize it is not a place to come with all my questions about which new camera to buy, my first digital SLR, after getting excited with the results of my digital point and shoot. Up to now, I had refrained from following the footsteps of all the other photographers in my family and never took my photography seriously. All that changed when I realized that editing my digital photos could finally give me the control over my images that I sought.

No, there is no point shopping here, I’d better look at cameras in Curaçao at a more relaxed pace, where the prices will certainly be lower. At least they used to be, when I was growing up and the island was still a duty-free paradise for American tourists.

Suddenly I remember that once, in these huge avenues of shops designed to entice travelers on the move, there used to be a stand with fresh, raw herring. I do not see it anymore, even though this is still the season of the celebrated first herring catch – the end of June. It fills me with longing, even though “new” herring was not something we ate at my home, it is what the “real Dutch” loved. Raw herring is a taste I developed later, and yet, it is so very much a taste from that past, perhaps from my acquired Dutch identity, and I feel that eating herring now would prepare me for my return. Read more

The Remarkable Decline In The Global North’s Leadership

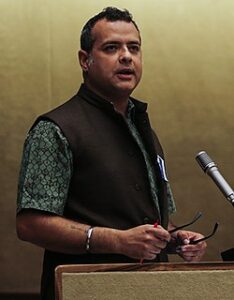

Vijay Prashad

03-05-2-24 ~ A group of young people in Paris are enjoying a drink in a café on an unseasonably warm evening. The conversation drifts into politics, but—as one young woman says—“Let’s not talk about France.” The others nod their assent. They focus on the U.S. presidential election, a slight bit of Gallic arrogance at play as they mock the near certainty that the main candidates will be President Joe Biden and former President Donald Trump. Biden is 81 years old and Trump is 77. A Special Counsel in the United States has called Biden an “elderly man with a poor memory,” hardly the words required to inspire confidence in the president. Trying to defend himself, Biden made the kind of gaffe that is fodder for online memes and affirmed the report that he tried to undermine: he called President Abdel Fattah El-Sisi of Egypt the “president of Mexico.” No new evidence is required, meanwhile, to mock the candidacy of Trump. “Is this the best that the United States can offer?” asks Claudine, a young student at a prestigious Parisian college.

These young people are aware enough that what appears to be comical on the other side of the Atlantic—the U.S. presidential election—is no less ridiculous, and of course less dangerous, in Europe. When I ask them what they think about the main European leaders—Olaf Scholz of Germany and Emmanuel Macron of France—they shrug, and the words “imbecilic” and “non-entity” enter the discussion. Near Les Halles, these young people have just been at a demonstration to end the Israeli bombing of the Rafah region of Gaza. “Rafah is the size of Heathrow Airport,” says a young student from England who is spending 2024 in France. That none of the European leaders have spoken plainly about the death and destruction in Gaza troubles them, and they say that they are not alone in these feelings. Many of their fellow students feel the same way. The approval ratings for Scholz and Macron decline with each week. Neither the German nor the French public believes that these men can reverse the economic decline or stop the wars in either Gaza or Ukraine. Claudine is upset that the governments of the Global North have decided to cut their funding for the United Nations Relief and Works Agency (UNRWA), the UN Palestine agency, although another young person, Oumar, interjects that Brazil’s President Lula has said that his country will donate money to UNRWA. Everyone nods.

A week later, news comes that a young soldier in the United States Airforce—Aaron Bushnell—has decided to take his own life, saying that he will no longer be complicit in the genocide against the Palestinians. When asked about the death of Bushnell, White House press secretary Karine Jean-Pierre said that the President is “aware” and that it is a “horrible tragedy.” But there was no statement about why the young man took his life, and nothing to assuage a tense public about the implications of this act. Eating an ice cream in New York, U.S. President Joe Biden said that he hoped that there would be a ceasefire “by the beginning of the weekend” but then moved it to “by next Monday.” The meandering statements, the pledge for a ceasefire alongside the prevarication, and the arms deliveries do not raise the confidence of anyone in Biden or his peers in Europe. With the Emir of Qatar beside him, France’s President Emmanuel Macron called for a “lasting ceasefire.” These phrases—“lasting ceasefire” and “sustainable ceasefire”—have been bandied about with these adjectives (lasting, sustainable) designed to dilute the commitment to a ceasefire and to pretend that they are actually in favor of an end to the war when they continue to say that they are behind Israel’s bombing runs.

In London, the UK Parliament had a comical collapse in the face of a Scottish National Party (SNP) resolution for a ceasefire. Rather than allow a vote to show the actual opinions of their members, both the Labour Party and the Conservative Party went into a tailspin and the Parliament’s speaker broke rules to ensure that the elected officials did not have to go on the record against a ceasefire. Brendan O’Hara of the SNP put the issue plainly before the Parliament before his words and the SNP resolution was set aside: “Some will have to say that they chose to engage in a debate on semantics over ‘sustainable’ or ‘humanitarian’ pauses, while others will say that they chose to give Netanyahu both the weapons and the political cover that he required to prosecute his relentless war.”

Global desire for an immediate stop to the Israeli bombing is now at an all-time high. For the third time, the United States vetoed a UN resolution in the Security Council to compel the Israelis to stop the bombing. That the United States and its European allies continue to back Israel despite the widespread disgust at this war—exemplified by the death of Aaron Bushnell—raises the frustration with the leadership of the Global North. What is so particularly bewildering is that large sections of the population in the countries of the North want an immediate ceasefire, and yet their leaders disregard their opinions. One survey shows that two-thirds of voters in the United States—including majorities of Democrats (77 percent), Independents (69 percent), and Republicans (56 percent)—are in favor of a ceasefire in Gaza. Interestingly, 59 percent of U.S. voters say that Palestinians must be guaranteed the right to return to their homes in Gaza, while 52 percent said that peace talks must be held for a two-state solution. These are all positions that are ignored by the main political class on both sides of the Atlantic Ocean. The qualifications of “lasting” and “sustainable” only increase cynicism among populations that watch their political leadership ignore their insistence on an immediate ceasefire.

Clarity is not to be sought in the White House, in No. 10 Downing Street, or in the Élysée Palace. It is found in the words of ordinary people in these countries who are heartsick regarding the violence. Protests seem to increase in intensity as the death toll rises. What is the reaction to these protests? In the United Kingdom, members of parliament complained that these protests are putting the police under “sustained pressure.” That is perhaps the point of the protests.

By Vijay Prashad

Author Bio: This article was produced by Globetrotter.

Vijay Prashad is an Indian historian, editor, and journalist. He is a writing fellow and chief correspondent at Globetrotter. He is an editor of LeftWord Books and the director of Tricontinental: Institute for Social Research. He has written more than 20 books, including The Darker Nations and The Poorer Nations. His latest books are Struggle Makes Us Human: Learning from Movements for Socialism and (with Noam Chomsky) The Withdrawal: Iraq, Libya, Afghanistan, and the Fragility of U.S. Power.

Source: Globetrotter

Boycott Israel? Maybe So, But Certainly Not At The Request Of ‘Palestine Solidarity Tilburg’

03-06-2024 ~ An open letter in my mailbox

On Thursday, February 29, an open letter (General Open Letter to All Faculties – Boycott Israeli Universities) from Palestine Solidarity Tilburg arrived in my university mailbox. The open letter came from a gmail account and was not signed by any person’s name.

Nowhere does Palestine Solidarity Tilburg introduce itself in the letter; there was also no website; the only clue is that the letter talks about ‘we as academics’. I therefore assumed that this concerns a group of people affiliated with Tilburg University. And the open letter also exudes that idea. It may be a number of my colleagues who took the initiative. The email is addressed to ‘deans, faculty boards, program directors, professors, lecturers, PhD candidates, researchers, and staff members of Tilburg School of Humanities and Digital Sciences’; in short, everyone, except the support staff of TSHD, and the latter surprised me because those staff can also feel and feel involved in the events in Gaza.

Hamas, October 7, genocide

The running text of the open letter mentions the word Hamas only once, but not in the capacity of the terrorist organization responsible for the murder, rape and torture of 1,200 Israeli civilians on October 7, 2023. The word ‘genocide’ appears 32 times and the word ‘genocidal’ four times. The date of October 7 is only mentioned as a point in time from when Israelis are said to have killed 28,775 Palestinians in Gaza (until February 19, 2024). Not a word about the Hamas massacre on October 7; not a word of sympathy for the victims. And the more words about Israel’s alleged genocide of the Palestinians. The open letter calls on Tilburg University to sever its partnerships with Israeli universities and institutions, especially because Israel would commit genocide against the Palestinian people.

My voice

In this piece I would like to voice a counterpoint and argue that if Tilburg University were to initiate such a boycott, it would in any case not do so in response to the open letter but on the basis of its own considerations. Furthermore, I personally believe that a boycott makes no sense and finally I would like to indicate why I think the open letter is very one-sided and therefore academically speaking reprehensible.

The Hamas Charter

Anyone who reads the Hamas charter fears the worst for the state of Israel. The charter reads like an ‘it is either us or them’ battle and should Hamas win the battle against Israel, nothing will be left of the Jewish state. In that respect, Hamas showed its true colors on October 7 when it went on a rampage of murder and rape in the affected Israeli villages and towns. You shouldn’t expect compassion from such an enemy. It is therefore not surprising that Israel wants to defend itself and do everything it can to destroy Hamas. For Israel goes as well that it is ‘them or us’. The open letter does not in any way mention Israel’s plight in this conflict and that is regrettable. The open letter gives me the impression that its authors do not even grant Israel a right to exist. Their ideas seem to fit into the discourse that stipulates that the establishment of the state of Israel was a neo-colonialist maneuver by the West to, among other things, maintain control in West Asia (the photo below the open letter depicts a banner on Tilburg University with the text ‘Cut ties with Israeli colonizers’; nomen est omen I would say). I would really like to know from the authors of the letter whether Israel is allowed to exist as a state at all.

Genocide

As mentioned, the word genocide is often mentioned in the letter. The letter refers to authoritative scholars in the field of genocide who state that Israel is unequivocally engaged in genocide. Yet the International Court in The Hague stated in its ruling earlier this year that ‘Israel is plausibly committing genocide’. It appears as if it is happening, the court says, but not that it is actually happening and Israel is called on to ensure that it does not happen. In the meantime, there are also scientists who argue that something more is needed to classify the current situation in Gaza as genocide. In no way does the open letter allow these voices to have their say, even though the senders of the letter give the impression of being academically trained. If that is the case, then you might expect them to show a really balanced analysis of whether Israel is actually committing a genocide. By the way, it is striking that the email contains the symbol , a picture of Palestine, ‘from the river to the sea’, which is interpreted, among other things, as the wish of Hamas and other Palestinians to establish a ‘Jew-free’ state of Palestine . Here too, nomen is omen. The picture is not in the open letter. Read more

Discarding Old Theories On The Path To Finding The First Humans Outside Africa

Deborah Barsky

03-06-2024 ~ Spectacular archeological finds reveal the true past of the first Europeans.

When I began studying human prehistory in the mid-1990s, little did I know that I would witness a paradigm shift in our understanding of when the first humans settled in Western Eurasia firsthand. At the time, I was preparing my master’s thesis about the stone tools from the Caune de l’Arago cave, an Acheulian site situated in the picturesque wine-producing village of Tautavel in southwestern France.

On a main road leading into the village, travelers encounter a road sign for Tautavel’s Prehistory Museum that reads: “L’Homme le plus ancien de l’Europe” (French for, The oldest Man of Europe). Excavations in the cave in 1971 yielded a semi-complete cranial fossil attributed to Homo erectus tautavelensis (a subspecies of H. erectus), estimated at 450,000 years old.

In 1995, I was invited to attend the International Congress of Human Paleontology that was held in the Andalusian town of Orce, Spain, where some very important archeological discoveries had recently been brought to light. Unbeknownst to me, the visit would not be my last.

An influential theory, known as the Short Chronology, published just one year prior to the congress in Orce, proposed that early humans only durably occupied Western Europe after around 500,000 years ago. The theory was published after the proceedings of a conference held in Tautavel in 1993: The Earliest Occupation of Europe, during which distinguished researchers reviewed and discussed the archeological evidence for the first sustained human presence in Europe. Even as the Short Chronology hypothesis took hold against the proponents of a Long Chronology (proposing that hominins were in Europe as early as 2 million years ago), it rapidly had to be revisited in light of a series of groundbreaking discoveries that would indelibly change the chrono-geographical setting of the first humans “out of Africa.”

From the 1980s, the UNESCO World Heritage site of Dmanisi, located in the Republic of Georgia between the Black and Caspian seas, began to report spectacular fossils of extinct animal species and then Oldowan stone tools. These findings were unearthed below the ruins of the Medieval town of Dmanisi in a volcanic sedimentary context dated to around 1.8 million years old. The vast open-air site, already well-known for its human settlements since the Bronze Age, continues to yield far earlier Paleolithic findings like those first exposed during excavations of the Medieval cellars. In 1991 a human mandible was discovered, beginning an astonishing series of finds that continue to contribute precious data about this little-known period of human prehistory. Ongoing excavations at Dmanisi have unearthed exceptionally well-preserved and diverse faunal remains (including extinct species of deer, horse, rhino, giraffe, and ostrich, as well as carnivores like saber-toothed cats, and giant cheetahs), along with stone tools attributed to the Oldowan cultural complex. In addition, the site has provided an unprecedented assemblage of fossil hominin remains that display a variety of anatomical features that led paleoanthropologists to create a distinct denomination for them: H. georgicus.

Prior to these discoveries, which are close to 2 million years old, only a few prehistorians had seriously considered the possibility that hominin groups were thriving outside of Africa even 1 million years ago. Their postulate was based in part on findings of primitive stone tools, often in agriculturally disturbed open-air contexts that are difficult to date with any precision, while few cave sites had produced convincing evidence. Indisputably, the exceptionally abundant, well-dated, and exquisitely preserved finds from Dmanisi provided irrefutable proof that hominins were indeed living “at the Gates of Europe” far earlier than previously believed. With the evidence from the Early Acheulian ‘Ubeidiya site in the Jordan Rift Valley (one of the earliest known H. erectus sites dating to around 1.5 million years ago), Dmanisi pushed back the date for the arrival of hominins in Eurasia, raising important questions, in particular, about which hominin was the first to successfully settle in lands situated outside of Africa.

The upheaval that followed in the wake of the Dmanisi discoveries—and those that would quickly follow—tells the story of how our own sociohistorical contexts influence what we think or what we believe when faced with hard evidence from the archeological record. There is no doubt that the extreme antiquity of the Dmanisi hominins created a paradigm shift within the scientific community that required rethinking the ideas entrenched in the dominant academic mindset. In retrospect, it demanded a total reconfiguration of the widely accepted scenario in which H. erectus was lauded as the first “colonizer” (a term clearly unfitting to describe ancient population dynamics and whose connotations anachronistically denote the modern concept of borders) of virgin territories outside of Africa. According to this scenario, H. erectus was put forward as the most likely candidate for undertaking such an achievement because it was doted with a larger brain and longer legs than its predecessors, and because it possessed a more advanced (Acheulian) toolkit, and even mastered fire making. Today, paleoanthropologists are still debating whether the Dmanisi hominins might have had some relationship with the African H. habilis, or if they were more closely related to the H. erectus.

Discoveries made in the 1990s at two sites in Orce; Barranco León and Fuente Nueva 3, would play a pivotal role in changing our ideas about the first peopling of Europe. The sites are situated in the Guadix-Baza Basin in northeastern Granada, an area long known for its extraordinarily preserved archeo-paleontological treasures dating to different periods. Today, Orce is a prominent site in the UNESCO Granada Global Geopark. Located nearly 1,000 meters above mean sea level, Orce currently offers a unique and arid landscape shaped by millions of years of accumulated geological deposits and erosion that fashioned a deeply faulted landscape, interspersed with vast badlands and surrounded by mountains. The scenery was very different more than 1 million years ago, however, when much of the area was occupied by a large saline lake and fresh water rushing forth from the surrounding mountains and the natural springs that still characterize the zone. The age of these two sites has been evaluated by a combination of dating methods to, respectively, 1.4 million and 1.3 million years ago.

Systematic excavations that are still ongoing began at the sites after indisputably human-made stone tools knapped from local flint and limestone were discovered in the early 1990s, in association with a broad range of faunal remains, including a huge species of mammoth (M. meridionalis), rhinos, horses, bison, and hippopotamus, as well as carnivorous predators like hyenas, wolves, saber-toothed cats, and wild dogs. Unsurprisingly, the anthropic nature of such ancient stone tools was a hotly debated topic during the Orce congress in 1995. These multilayered open-air sites, situated on the fluctuating lake margin in a swampy environment frequented by many animals, provided an attractive scenario for the hominins who used their stone tools to create their own niche, even withstanding changes in climatic conditions more than 1 million years ago. Their presence predates the oldest documented Acheulian-producing hominins in Europe, demonstrating the efficacy of Oldowan toolkits and underpinning the need for changes in the dominant paradigms about the first inhabitants of Europe.

Buttressing the indisputable evidence emanating from these well-dated and systematically excavated sites came the announcement of groundbreaking discoveries from level TD-6 of the Gran Dolina site at the Sierra de Atapuerca in Burgos, Spain, where a new set of hominin remains, stone tools and fauna was published in 1995. The spectacular hominin fossils, some 0.9 million years old, presented a distinct set of anatomical traits, justifying the naming of a new species: H. antecessor, finally putting to rest any remaining skeptics questioning the veracity of the great antiquity of the arrival of the genus Homo in Europe.

Since these pioneering discoveries were made known, the number of excavated sites with stone tools attesting to a hominin presence predating 1 million years ago continues to increase, in particular, around the Mediterranean basin. While we still know relatively little about the hominins responsible for these accumulations, the fossil record is steadily increasing in pace with continued discoveries and excavations in some of the key areas. In 2008, a new set of hominin remains, stone tools, and fauna was published from level TE-9 of the Sima del Elefante site in the Sierra de Atapuerca, with an age of around 1.2 million years old. Then, in 2013, the discovery of a human deciduous molar was published from Orce’s Barranco León site in a level dated close to 1.4 million years old. Meanwhile, at the Eastern end of Eurasia, a growing body of evidence from China suggests that hominins were present there nearly 2 million years ago.

Archeology is teaching us that in order to truly understand how humans came to expand across the globe during the Lower Paleolithic, we need to keep our minds open and embrace the science—even if it means modifying or even discarding the long-held ideas that are shaping our own historical moment.

By Deborah Barsky

Author Bio:

Deborah Barsky is a writing fellow for the Human Bridges project of the Independent Media Institute, a researcher at the Catalan Institute of Human Paleoecology and Social Evolution, and an associate professor at the Rovira i Virgili University in Tarragona, Spain, with the Open University of Catalonia (UOC). She is the author of Human Prehistory: Exploring the Past to Understand the Future (Cambridge University Press, 2022).

Source: Human Bridges

Credit Line: This article was produced by Human Bridges.

PVV Blog 5 – The ‘Monocultural Confession’ Of The Dutch Party For Freedom

03-05-2024 ~ Party for Freedom MP and Speaker of Parliament Martin Bosma presents the ‘20 foundations of the Multicultural Confession of Faith’ in chapter 7b of his book De schijn-élite van de valse munters.

03-05-2024 ~ Party for Freedom MP and Speaker of Parliament Martin Bosma presents the ‘20 foundations of the Multicultural Confession of Faith’ in chapter 7b of his book De schijn-élite van de valse munters.

This ‘Multicultural Confession of Faith’ is said to have ‘made a great impression on the elites of the Netherlands’. This ideology would ‘involve the flattening of the leading culture in favor of minority/immigrant cultures’, Bosma claims. The multicultural ideology is, according to Bosma, based on a number of foundations, namely the following:

• 1 Multicultural societies are superior to monocultural societies;

• 2 Mass immigration is inevitable, the influx can be attributed to globalization;

• 3 Mass immigration is the result of guest labor;

• 4 Mass immigration is good for the economy, for healthcare and the welfare state. We need immigrants;

• 5 We also have a moral obligation to welcome large groups of foreigners as a way to make up for the Second World War, our colonial past, slavery or the Crusades;

• 6 Mass immigration should be viewed purely nationally. The behavior of Muslims in other countries is of no importance to the Netherlands;

• 7 Today’s mass immigration can be compared to the arrival of immigrants in the sixteenth century (to the Netherlands). Muslims will assimilate, it is a matter of time. Muslims are Huguenots in the making;

• 8 Islam is a religion and will therefore develop like all other religions, namely towards a liberal version or even an Enlightenment;

• 9 There is a moderate Islam;

• 10 Christians have also had their pranks, so don’t whine about Islam;

• 11 The Bible also contains strange things, just like the Koran does. So there is no problem;

• 12 Muslims’ commitment to their ideology should be denied or underestimated, problems they may cause are explained by socio-economic conditions;

• 13 At most, these problems concern a single Moroccan street thief. Demographically, the Muslim influx poses no problem whatsoever;

• 14 Muslims form a ‘vulnerable group’ and therefore deserve extra protection from the government;

• 15 Welfare state and immigration country go well together;

• 16 The problems started with the Party for Freedom. If Wilders would just stop, the issues would soon be over;

• 17 Anyone who opposes Islamization belongs to the extreme right;

• 18 The lesson of the Second World War is that any form of patriotism or nationalism is wrong and tolerance is always good;

• 19 The ‘May 1968-left’ movement, which was ultimately wrong about communism, is now right about Islam and the multicultural society’.

And then Bosma writes before formulating the twentieth article:

‘And especially this one:

*20 If the multiculturalists are wrong, the Netherlands and the West will get a second chance’.

Dixit Martin Bosma. And as a final comment he states the following:

‘These foundations have never been thought through or proven. In fact, they are all wrong’.

The elite impressed by the confession of faith

Martin Bosma has placed himself in the world of thought of ‘the elites’ and has from that perspective considered society, especially when it comes to ‘mass immigration’ and ‘Islam’. He has not defined who constitutes ‘the elites’ nor has he researched or quoted what the elites really think about these topics. It is his interpretation of what ‘the elites’ think. The foundation on which this thought exercise stands is therefore weak. But this empirical or scientific argument is of course not important to Bosma. Bible verse Isaiah 20:5 in his book is leading. The text reads as follows:

“Woe to those who call evil good and good evil; who represent darkness as light and light as darkness; who pass off bitter as sweet and sweet as bitter’.

For Martin Bosma, the world consists of either good or evil and woe to those who call evil good or good evil. It is therefore not surprising that Bosma states that the 20 foundations of the ‘Multicultural Creed’ are incorrect or ‘evil’.

The ‘Monocultural Creed’

If all 20 points of the Multicultural Creed are incorrect, and therefore ‘evil’, then the Party for Freedom version of that creed would be ‘good’, and would be called the ‘Monocultural Creed’, and the 20 statements would read as follows :

• 1 ‘Multicultural societies are not superior to monocultural societies;

• 2 Mass immigration is not inevitable, the influx cannot be attributed to globalization;

• 3 Mass immigration is not the result of guest labor;

• 4 Mass immigration is bad for the economy, for healthcare and the welfare state. We don’t need immigrants;

• 5 We do not have a moral obligation to welcome large groups of foreigners as a way to make up for the Second World War, our colonial past, slavery or the Crusades;

• 6 Mass immigration should not be viewed nationally. The behavior of Muslims in other countries is of great importance to the Netherlands;

• 7 Today’s mass immigration cannot be compared to the arrival of immigrants in the sixteenth century. Muslims are not going to assimilate, it is not a matter of time. Muslims are not Huguenots in the making;

• 8 Islam is not a religion and will therefore not develop like all other religions, namely in the direction of a liberal version or even an Enlightenment;

• 9 There is no moderate Islam;

• 10 Christians have not (had) any pranks, so the more reason there is to whine about Islam;

11 There are no strange things in the Bible, unlike the Koran. So there is a problem;

• 12 The commitment of Muslims to their ideology should be recognized or not underestimated, problems they cause are not explained by socio-economic conditions;

• 13 These problems are really not about a single Moroccan street thief. Demographically, the Muslim influx poses a major problem;

• 14 Muslims do not form a ‘vulnerable group’ and therefore do not deserve extra protection from the government;

• 15 Welfare state and immigration country do not go together at all;

• 16 The problems did not start with the Party for Freedom. If Wilders just stops, the contradictions will certainly not be over;

• 17 Anyone who opposes Islamization is not extreme-right;

• 18 The lesson of the Second World War is that any form of patriotism or nationalism is good and tolerance is not good;

• 19 The ‘May-1968-left’ movement, which was ultimately wrong about communism, is now wrong about Islam and the multicultural society;

• 20 If the multiculturalists are wrong, the Netherlands and the West will not get a second chance’.

Further analysis

A guiding principle in this series is the question of ‘whether things are as bad as they look’.

The ideas of the Party for Freedom as expressed in the book by parliament chairman and party ideologue Marin Bosma are sharp and reject all forms of migration and Islam.

When the party sat down in governmental coalition negotiations the party withdrew a number of unconstitutional bills relating to Muslims in the Netherlands. Party leader Wilders also conformed to the view of the other three potential coalition parties, that Islam is a religion that enjoys protection under the Constitution, in contrast to his previous view that Islam is a ‘totalitarian ideology’.

But, religion or ideology, party leader Wilders reiterated his view on Islam in a parliamentary debate: ‘So, I still think that Islam as a religion is a reprehensible, hateful religion that incites violence. So the (Party’s) position on Islam will not change.’

If the Party for Freedom enters a new government, it is certain to me that the 20 statements of the ‘negative monocultural Party for Freedom ideology’ will become visible in one way or the other, directly or indirectly, in statements and bills from a possible Party for Freedom government.

A party that has spoken out so clearly in negative terms about immigration and Islam does not deny its roots. Impossible.

The Adaptive Value Of Teenagers: How Peer Learning Contributes To Primate Success

Brenna R. Hassett

03-01-2024 ~ Anthropological science is our species’ attempt to address our most fundamental questions about who we are and how we got here. It asks for evidence of the evolutionary path we have traveled to become the most successful primate on the planet; it seeks clues as to why Homo sapiens—and not our recent relatives—came to be the sole survivor of millions of years of hominid evolution. Many singular traits of our species and those of our immediate ancestors have been held up as prime movers in making us a world-dominating ape: controlling fire, walking upright, and making tools. However, more than anything, the evolution of big brains in the Homolineage around 2 million years ago is often identified as a turning point where we started to become the thinking animal. At some point in our evolutionary history, we became the ape that learns—and capacity for learning might just be the thing that let Homo sapiens become the species that we are today.

Of course, Homo sapiens is not the only animal that learns. It’s certainly not the only primate either—learning is a critical part of our closest relatives’ repertoire. Rather than relying on instinct, many primates pick up skills and information by learning them. In many species, learning is done through observation, which is as simple as it sounds: a baby will watch its mother to learn what foods are good to eat, or the young watch an experienced adult doing a particular task. As social animals, primates have a greater number of teachers available to them than other species, and who they learn from changes as they grow. Infant vervet monkeys, for instance, quickly learn to eat the foods their mothers like—but when they get older and move to a new group where that food isn’t liked, they will quickly learn to eat what their peers eat.

Primate life demands a host of skills that aren’t passed down through instinct alone—and aren’t always just survival skills. One of the best examples of such a skill is seen in the gloriously relaxed snow monkeys of the northern Japanese island of Hokkaido. The snow monkeys are a type of macaque, one of the most numerous (and interesting) monkey species, with a broad range of habitats around Asia and a host of different adaptations to live in each environment. The adaptation of the Hokkaido macaques, however, is something else again: they have taught themselves to bathe in the hot tub. In the 1950s tourism to the natural hot springs of Hokkaido led to the construction of hotels and onsen, traditional Japanese baths, in a group of macaques’ territory. One day a young macaque fell into an onsen while chasing an apple, and realized it was actually quite nice. Her peers watched and learned and then taught their children how to hot tub too, and so it became an established behavior among the group.

Peer learning is incredibly important for juvenile primates, precisely because of the complicated social groups they live in. As any teenager could tell you, it’s a matter of survival to fit in with your group, and, depending on your species, many young animals will move groups and have to learn entirely new ways of doing things. In some species, it will be the females that move groups, and they will carry with them any new skills from their home groups while also learning to adapt to new ones. In others, it will be males who may have a host of other challenges to overcome as they leave their birth groups. Gorillas, for instance, have a very rigid “harem” style social organization, with a handful of silverback males living with several females and their children. When the male children start to get older, they can either stay in their own groups and try to compete, or they can join special boy bands comprising those males that are too young (or too old) to challenge a silverback for a harem of their own. There, they can learn and practice the skills they need to build their own harem.

Peer learning is incredibly important to our species precisely because it is a way of transferring information beyond our own native social groups. Like the hot tubbing macaque or the young male gorillas, movement to a new group means that new ideas and skills are transported beyond their group of origin. Cultural transmission becomes possible, and ideas and adaptations are free to spread to wider groups. This means the number and scope of adaptations circulating is vastly increased—and with it, the evolutionary chances of the species. Humans have taken full advantage of this kind of learning by simply taking more time to do it. We take longer to move from puberty to full adulthood than any other species of primate. Indeed, when full adulthood actually occurs in our species is a matter of considerable debate.

When we look at the time in life when peer learning occurs, we see that it is when animals are on the cusp of adulthood—the ones that are mobile, changing groups, and playing around in an onsen—that contribute to this kind of wider learning. This is something that our species knows only too well. For anyone who has ever asked what the adaptive value of teenagers might be—or really, anyone during the long period between childhood and full adulthood that our species gives its young—the answer is simple. One of the most important adaptations we have made along the evolutionary path that has led to our species being the most prolific and successful primate on the planet is the time we take to learn how to be a better monkey.

By Brenna R. Hassett

Author Bio:

Brenna R. Hassett, PhD, is a biological anthropologist and archaeologist at the University of Central Lancashire and a scientific associate at the Natural History Museum, London. In addition to researching the effects of changing human lifestyles on the human skeleton and teeth in the past, she writes for a more general audience about evolution and archaeology, including the Times (UK) top 10 science book of 2016 Built on Bones: 15,000 Years of Urban Life and Death, and her most recent book, Growing Up Human: The Evolution of Childhood. She is also a co-founder of TrowelBlazers, an activist archive celebrating the achievements of women in the “digging” sciences.

Source: Human Bridges

Credit Line: This article was produced by Human Bridges.